The Financing Process

Demystifying Home Mortgage

The home mortgage process can feel overwhelming

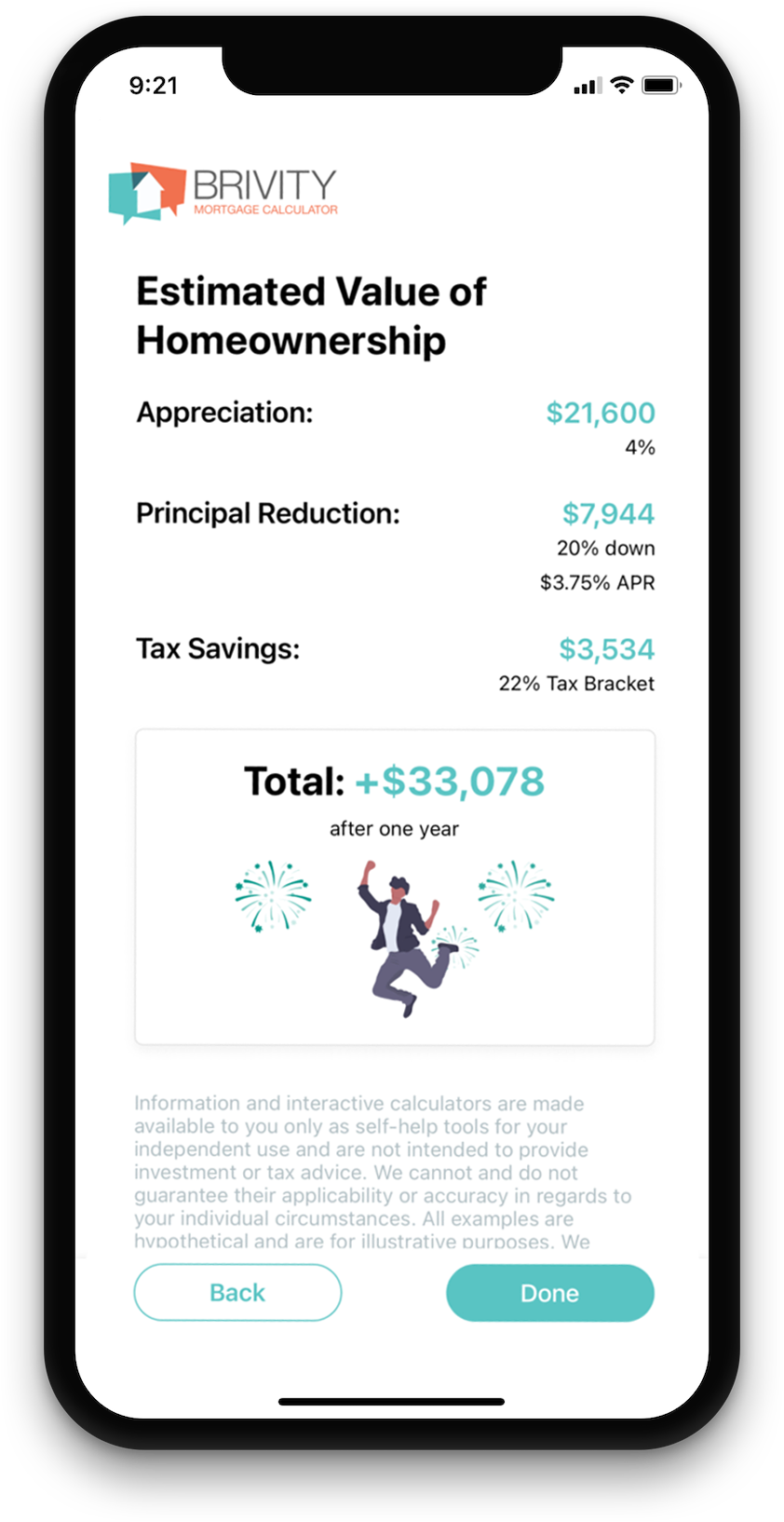

If you haven’t experienced it before, the home mortgage process can feel overwhelming, but our agents will help you stay informed throughout the process, from pre-approval to closing. The first thing to do is consult with a mortgage specialist (or two). If you don’t already have someone in mind, we partner with some of the best specialists in the industry, and we’d be happy to introduce you, so you’ll be taken care of.

Step One:

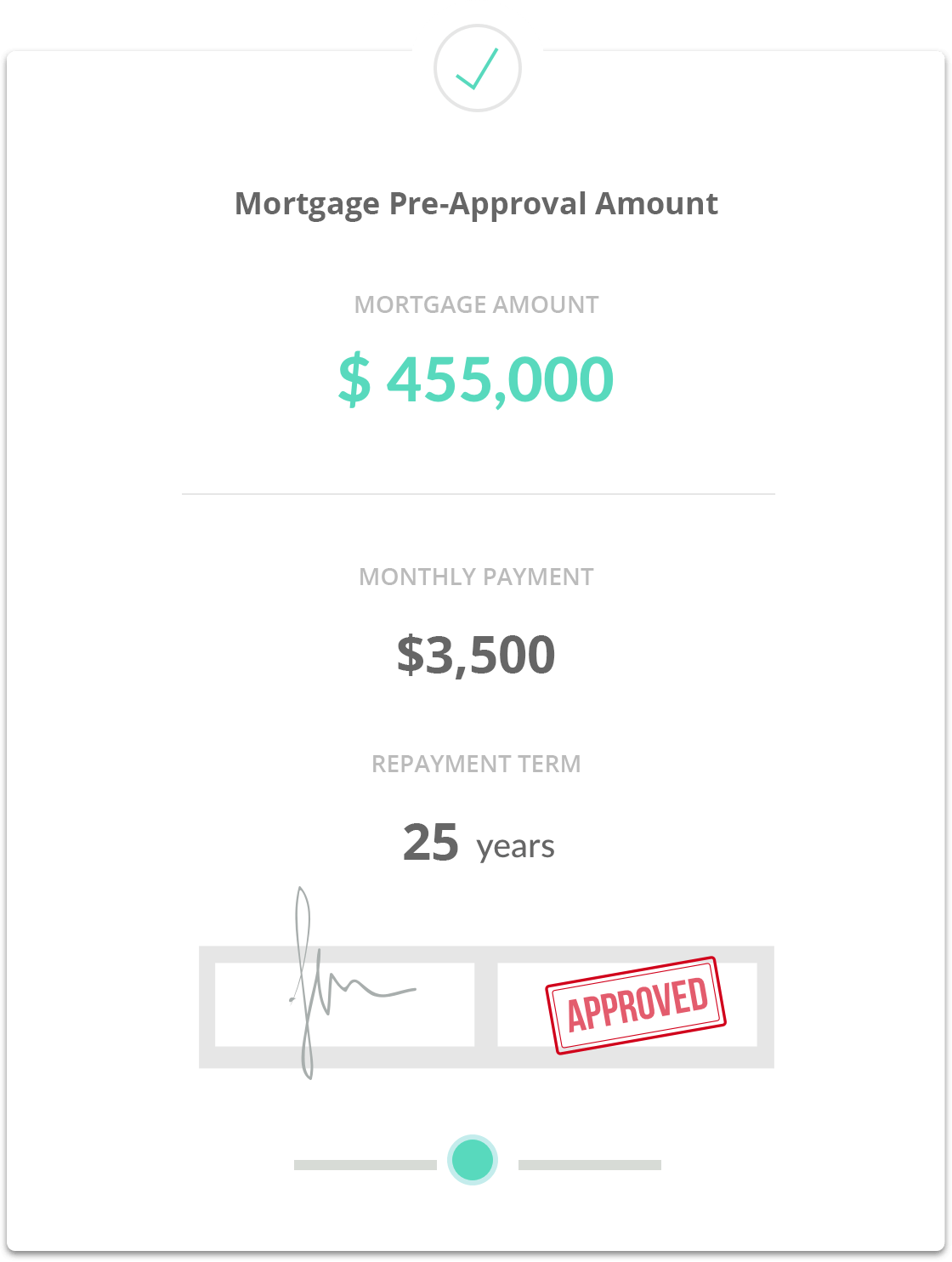

Get pre-approval

Before you start looking for a home to buy, it’s a good idea to meet with your mortgage broker to get pre-approved for a mortgage amount. At this stage, the mortgage specialist gathers information about income, assets and debts of the borrower (you) to determine how much house you may be able to afford. This includes a credit report, pay stubs, T-4's and recent bank statements. There are a variety of different mortgage programs, so make sure to get pre-qualification for the specific programs that best suit your needs.

Estimate Your Monthly Payment

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)HOA

$100.00

(3.1%)Insurance

$200.00

(6.3%)Step Two:

Find the best mortgage

When you find property you’re ready to buy, your mortgage specialist will help you complete a full mortgage application, and talk you through the various fees and down payment options. The application is submitted to processing, where the documents are reviewed and appraisals and title examination are ordered. Then the mortgage is sent to an underwriter, who reviews and approves the entire mortgage if it meets compliance.

Step Three:

Application and Processing

When you find the perfect property and your offer is accepted, your lender will help you complete a full mortgage loan application, discuss down payment options, and explain any related fees.

Then, your application is submitted for processing where the documents are reviewed. Your lender will also order a home appraisal and a property title search.

The next part of the application process involves sending everything to an underwriter who will review and approve the entire loan package to make sure it meets all compliance regulations.

It is not unusual to receive requests for additional documentation or clarification during this phase of the application process.

Step Four:

Signing and Finalizing the deal

Once your loan is approved, you’ll need to set up homeowners insurance.

Your documents will be sent to the title company and the closing will be scheduled for you to sign the necessary paperwork and pay any additional costs to complete the purchase of your new home.

After the loan goes through the required recording process, the purchase is complete, and you officially own your new home!